Most congressional precedents emanate from Capitol Hill.

Most presidential precedents emerge from 1600 Pennsylvania Ave.

But a precedent which may echo around the halls of Congress and the White House for years materialized in recent days in the snow-covered, wooded village of Chappaqua, New York.

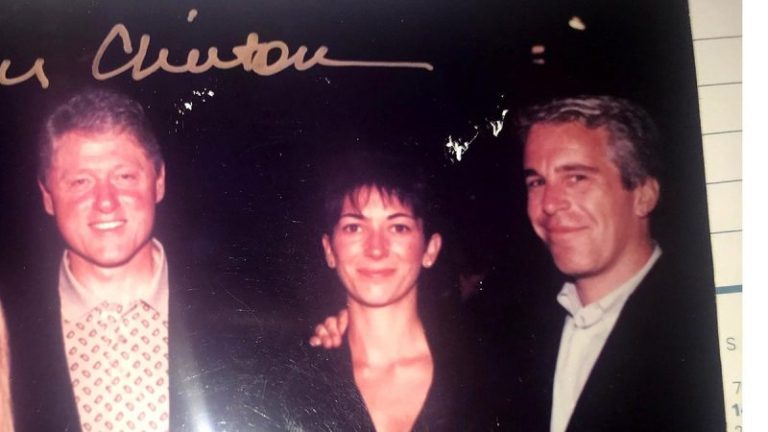

That’s where former President Bill Clinton testified under subpoena to the House Oversight Committee as part of its investigation into Jeffrey Epstein. Lawmakers said the panel’s ability to compel testimony from a former president could establish a new precedent going forward — including in matters involving President Trump and the Epstein files.

According to congressional historians, never before has a congressional committee deposed a former president. It was rare enough to have former First Lady and former Secretary of State Hillary Clinton testify the day before. Republicans noted that former President Clinton had previously acknowledged knowing Epstein and traveling on trips that included him.

‘I do not recall ever encountering Mr. Epstein. I never flew on his plane or visited his island, homes or offices,’ said Hillary Clinton after nearly six hours of closed-door testimony before the panel.

House Oversight Committee Chairman James Comer, R-Ky., said Hillary Clinton declared ‘‘You’ll have to ask my husband,’’ more than ‘a dozen’ times during her deposition ahead of Bill Clinton’s the following day.

There are no accusations of wrongdoing against either of the Clintons in connection with Epstein. But the former president’s past ties to Jeffrey Epstein have spurred questions from lawmakers.

‘It’s very difficult to get people in for these depositions of great power and great wealth,’ said Comer. ‘It took seven months, seven months to get the Clintons in here. But we’ve got them in here.’

‘Here’ was Chappaqua, about an hour north of New York City. The Clintons have resided in Chappaqua since President Clinton left office in 2001 and when Hillary Clinton ran for Senate from New York in 2000. Hillary Clinton served as a senator from New York from 2001 until 2009, when she became President Obama’s first Secretary of State.

More specifically, the ‘here’ for the Clintons’ testimony was not a bland office in the Rayburn House Office Building. House members questioned the Clintons at the Chappaqua Performing Arts Center, known locally as ‘ChappPAC,’ a white structure with simple arcades and Greek columns atop a hillside above the Saw Mill River.

The Epstein inquiry is serious, and the unusual venue underscored the extraordinary nature of the proceeding.

Rep. Lauren Boebert, R-Colo., appeared to snap a photo of Hillary Clinton during the deposition, then shared it with conservative media outlets.

‘I admire (Hillary Clinton’s) blue suit. So I wanted to capture that for everyone,’ said Boebert outside the venue.

‘Why did you send the picture?’ asked a reporter.

‘Why not?’ retorted Boebert.

‘We are sitting through an incredibly unserious, clown show of a deposition, where Members of Congress and the Republican Party are more concerned about getting their photo op of Secretary Clinton than actually getting to the truth and actually holding anyone accountable,’ charged Rep. Yassamin Ansari, D-Ariz.

After concluding her testimony, Hillary Clinton told reporters she found the ‘end’ of the deposition to be ‘quite unusual because I started being asked about UFOs and a series of questions about Pizzagate, one of the most vile, bogus conspiracy theories that was propagated on the internet.’

That is a reference to a conspiracy theory that emerged during the 2016 presidential campaign between Hillary Clinton and President Trump. Proponents falsely claimed Democrats operated a child sex trafficking ring out of the Comet Ping Pong pizza shop in Washington. A North Carolina man later drove to Washington, D.C., and fired shots inside the restaurant, telling authorities he was there to rescue children.

Rep. Nancy Mace, R-N.C., asserted that Hillary Clinton was ‘screaming’ at lawmakers during the deposition.

‘She was unhinged,’ said Mace. ‘And I hope that President Clinton is less unhinged today than his wife was yesterday.’

Rep. Anna Paulina Luna, R-Fla., emerged from the Chappaqua Performing Arts Center about 90 minutes into former President Clinton’s deposition to speculate about what may have been behind Epstein and his sex trafficking operation. Luna noted she was speaking only for herself and not other members of the committee.

‘It has become very evident even in the last 24 hours in lines of questioning that Jeffrey Epstein was running an intelligence gathering operation,’ said Luna. ‘I do believe it was a honey pot operation.’

Luna added that it was possible a U.S. intelligence ally was involved, though she provided no evidence for the claim.

One of the five agreed-upon areas of questioning for the Clintons was how Epstein used his connections with powerful figures to hide his crimes. That is why individuals such as former President Clinton and President Trump have surfaced in previously released Epstein-related documents.

The presidency is a unique office, and even President Trump expressed some sympathy for Bill Clinton’s appearance before the Oversight Committee.

‘I don’t like seeing him deposed. But they certainly went after me a lot more than that,’ said the president.

When pressed on Friday, President Trump said he was unfamiliar with the Epstein files.

‘I don’t know anything about the Epstein files. I’ve been totally exonerated,’ said President Trump.

Oversight Committee Republicans were asked whether they agreed with that claim.

‘From all the evidence I’ve seen he’s been exonerated for a long time,’ replied Comer.

‘The Epstein victims have exonerated President Trump. This is a trope that you guys are — a rabbit hole you guys are going down. But he’s been exonerated over and over again by Epstein victims,’ said Mace.

But Democrats questioned why the committee sought testimony from former President Clinton and not President Trump.

‘There is a lot of email correspondence that included President Clinton,’ said Comer.

Rep. Robert Garcia, D-Calif., the top Democrat on the Oversight panel, argued the move set a broader standard.

‘There’s a precedent now,’ said Garcia. ‘We now want President Trump to come in and to testify under oath in front of the Oversight Committee. We want the First Lady, who we know had a relationship as well with Jeffrey Epstein, to come under oath and testify to the Oversight Committee. That is the new precedent that Republicans wanted to set here.’

Garcia added that President Trump ‘has not been exonerated, and we have serious questions for President Trump.’

Rep. Suhas Subramanyam, D-Va., argued that the committee spoke ‘to the wrong president.’

It is unclear whether the panel will seek testimony from President Trump. Democrats have indicated they would consider doing so if they gain control of the House in the fall midterm elections.

Separation of powers is a key component of America’s constitutional system. Only a handful of presidents have ever testified before Congress — and none had previously been deposed as a former president.

The nation’s history includes small communities that have taken on outsized political significance. Lawmakers and legal observers say Chappaqua could now join that list if presidential testimony before Congress becomes more common.