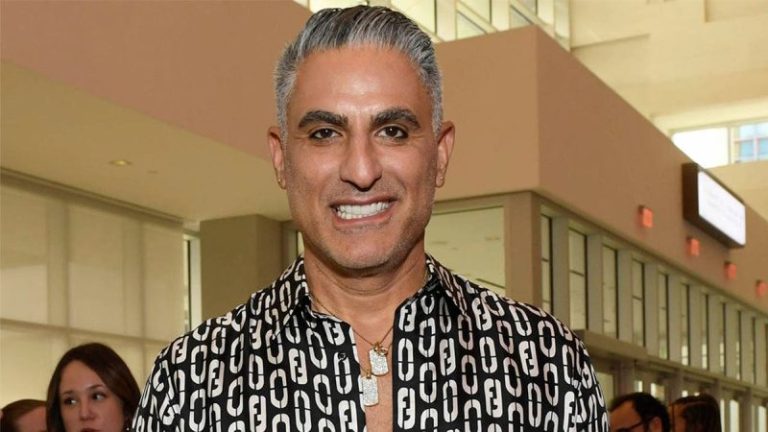

‘Shahs of Sunset’ star Reza Farahan is speaking out about the United States and Israel’s military action against Iran.

During an interview with Fox News Digital, the Iranian-born 52-year-old reality star, who authored the forthcoming book ‘Memoirs of a Gay Shah,’ explained that he and his family came to America on a family trip in 1977 and ended up staying after unrest in Iran escalated into revolution.

During the 1979 Iranian Revolution, the country’s former monarch, Shah Mohammad Reza Pahlavi, was overthrown and replaced by Ayatollah Ruhollah Khomeini, who established an Islamic Republic that transformed the country into a theocratic state governed by strict religious rule.

Last weekend, U.S. President Donald Trump and Israeli Prime Minister Benjamin Netanyahu launched coordinated strikes on Iranian military and nuclear targets, during which Iran’s Supreme Leader Ayatollah Ali Khamenei was killed. Iran retaliated with missile and drone strikes against Israel and U.S. military bases in several Middle Eastern states.

The conflict comes on the heels of widespread anti-government protests in Iran that erupted in December 2025 and were met with brutal crackdowns by the government that left thousands dead.

During an interview with Fox News Digital, Farahan shared his insight into how Iranians living in the country have reacted to the U.S. and Israel-led strikes.

‘I’ve spoken to relatives and friends who are in Iran, and I know it’s hard for non-Iranians to understand this, but the Iranians in Iran are so happy that there is military intervention that has come to help rescue them from the Islamic Republic,’ he said.

‘I know, especially for people that are anti-our President, they can’t understand why,’ Farahan continued. ‘Why are the people in Iran happy? They’re happy because the prospect of freedom is something that they’ve dreamed of for so many years.’

‘I urge the American population to do their own research, keep an open mind, and think about what the Iranians inside of Iran are begging for,’ he added.

Farahan also described the response that he was seeing in the Iranian-American community.

‘Utter elation and gratitude for the prospect that there could be potential regime change and freedom for people that have been oppressed by a fanatical religious dictator for 47 years,’ he told Fox News Digital.

According to a recent Fox News poll, American opinion on the U.S. military action against Iran is sharply divided. While 65% of voters see Iran as a serious national security threat, about 50% of those polled approve of the strikes and about 50% disapprove.

Support and opposition broke down strongly along partisan lines. According to the survey, more than 8 in 10 Republicans approve of the current U.S. use of force, while only 6 in 10 say the president’s actions on Iran are making the U.S. safer.

Nearly 8 in 10 Democrats disapprove of the U.S. strikes and think things are less safe because of Trump’s performance, while 6 in 10 or more independents think the same on both counts.

Meanwhile, two-thirds of voters said they were generally concerned that Trump’s use of executive orders and acting without Congressional approval may be permanently altering the country’s system of checks and balances.

During his interview with Fox News Digital, Farahan addressed critics of the military action, arguing that partisan politics shouldn’t cloud judgment. He also warned that Americans opposing the action may be underestimating the threat posed by the Islamic Republic and the country’s primary military branch, the Islamic Revolutionary Guard Corps (IRGC).

‘My message to people criticizing the action in Iran is one: please don’t allow your political bias to interfere with understanding that freeing Iran is making the world a safer place,’ he said. ‘When the creed and motto of a dictator is ‘Death to America,’ and they force the people to chant that all the livelong day, believe them.’

‘That’s not just a message, it’s their goal,’ Farahan continued. ‘They just don’t have the ballistic missiles that will reach America currently, but that is what they’re working towards. And freeing Iranians from the IRGC and the Islamic Republic not only helps them, it helps us for generations to come.’

Farahan has previously said that he first came out as gay to his mother at the age of 21. He became one of the first openly gay Persian-American reality TV stars when ‘Shahs of Sunset’ premiered on Bravo in March 2012. Farahan’s relationship with his now husband Adam Neely was prominently featured on the show with the duo tying the knot in an episode of the show that aired in October 2015.

Farahan remained a member of the main cast throughout the show’s nine-season run until August 2021. He went on to appear in other reality shows including ‘Worst Cooks in America’ and ‘The Traitors.’ Farahan is currently starring on the Peacock reality series ‘The Valley: Persian Style.’

While speaking with Fox News Digital, Farahan shared his view on the Iranian-American experience and explained how he was grateful as an openly gay man to be living in America.

‘We are a minority group that assimilated and worked our butts off in this country to contribute and show our gratitude to this new homeland that we have,’ he said. ‘And there’s not a day that goes by that I don’t express gratitude to my father-in-law, who’s a retired Air Force Colonel, or anyone that serves in the U.S. Armed Forces that protects me and my family and this beautiful country and allows me to be free here. ‘

He continued, ‘Because if I were in Iran, 100% I wouldn’t — I would not have made it to this age. I would have been killed. Gay people are stoned to death or hung from cranes regularly.’

Farahan told Fox News Digital that the current conflict in Iran has ‘strengthened my pride in being an American citizenHe explained that when he was growing up, he had recurring nightmares of being sent back to Iran.

‘I’m so proud to have a U.S. passport,’ he said. ‘The thought of not being in America anymore was just so scary to me. So for anyone out there listening: God bless America. I love this country, and I’m grateful for it every single day.’

Farahan acknowledged he may face financial losses for his political views, but he said he feels obligated to speak for those in Iran killed for defying Islamic dress codes — including the legal requirement for women to cover their hair with a hijab — or their sexual orientation.

‘I think to myself: I have a duty,’ he said. ‘And I may suffer financially because people may not buy my book because they may not like what I have to say politically, but I have a duty to those people who were killed because their hair was exposed, or their acid was thrown in their faces of these beautiful women because they didn’t observe the hijab rules.’

‘I have a duty to those people because I’ve benefited from living in this beautiful country for basically my entire life,’ he continued. ‘I was three and a half years old when we left Iran. So whatever backlash I get, hopefully it’ll be worth it for speaking for the ones who can’t speak.’

Farahan’s book ‘Memoirs of a Gay Shah’ follows his journey from moving to the U.S. as a child just before the Islamic Revolution to growing up as an immigrant in Beverly Hills and becoming an openly gay reality television star. He told Fox News Digital that his memoir is also an immigrant success story and a celebration of the American Dream.

‘I want the people that read my book to know that this little brown kid came to a country at a time when people were side-eyeing my parents, looking at them like they were related to the terrorists that were holding those American hostages in captivity, yet somehow I found the beauty here,’ he said. ‘And I was able to find my dreams and prosper like no one else has. So when I tell you that America is the land of the home, is the home of the brave, the land of the free, and that you can have anything you want in this beautiful country, regardless of how you look and who you are, believe me, because I did it.’

‘If you wanna know how I did, read the book,’ he continued. ‘But the net result is this country is the greatest place on earth. And I’m so grateful because I was able to fulfill my dreams here. And if I had stayed in Iran, I’d be six feet under.’

‘Memoirs of a Gay Shah’ will be released on April 7.

Fox News Digital’s Dana Blanton contributed to this report.