A multi-year grant to a Washington-area nonprofit focused on promoting fishing, boating and outdoor activities was canceled by the Interior Department after Senate DOGE leadership flagged the original Fox News Digital report to the Cabinet agency.

More than $26 million has already been paid out – on top of $164 million since 2012 – to the Recreational Boating and Fishing Foundation (RBFF), based in Alexandria, Virginia.

From the government website USA Spending, the grant’s purpose highlights RBFF’s ‘Take Me Fishing’ consumer campaign that includes a social and digital media component, as well as ads on Walt Disney Company-branded streaming services and ‘mobile fishing units’ that cater to urban communities and ‘underserved audiences.’

At least $40.5 million will be saved in the near-term, the Senate DOGE Caucus told Fox News Digital, citing Interior’s response.

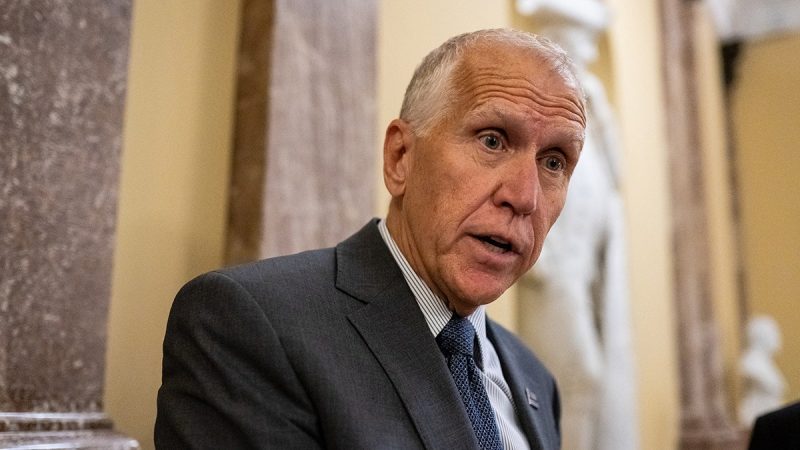

‘Today’s catch of the day is Washington waste,’ said Senate DOGE Caucus Chairwoman Joni Ernst, R-Iowa.

‘I am proud to have exposed bloated overhead costs and worked with Secretary Burgum to ensure tax dollars collected to boost fishing are not siphoned into the pockets of slick D.C.-based consultants.’

‘There’s more pork in the sea, and I am going to keep fishing for it!’

Burgum’s office struck a similar tone, saying the agency is committed to fiscal responsibility, efficiency and accountability – while still fully supporting the recreational boating, fishing and outdoors industries.

A spokeswoman for the agency, which oversees the National Park Service that provides outlets for all of the above, said that ‘under President Donald J. Trump’s leadership, we are ensuring that every taxpayer dollar serves a clear purpose and aligns with our core mission.’

‘Following a review of discretionary spending, the Department determined that the use of this particular [RBFF] grant had not demonstrated sufficient alignment with program goals or responsible stewardship of taxpayer resources,’ Charlotte Taylor said.

The grant, largely funded by excise taxes on fishing poles, came under DOGE scrutiny when Ernst discovered an RBFF contract with Disney worth $1.99 million plus hundreds of thousands in ‘SEO consulting,’ and $5 million to a Minnesota creative media development agency. Several RBFF executives are paid from the mid-$100,000s on up.

In part of a lengthy response to the grant’s cancellation, RBFF officials told Fox News Digital the organization has ‘devised a plan we believe would meet the goals and priorities of the administration, which includes adjusted employee compensation, reduced headcount and updated investment priorities.’

But the group claimed it has not been able to connect directly with DOGE or Interior during the grant review process ‘despite repeated outreach attempts during the past three months.’

A source familiar with the situation indicated the group had met with Ernst’s office, and Taylor said Burgum’s office did meet with RBFF in Washington earlier this month and has been in contact ‘multiple’ times: ‘Anything to say otherwise is inaccurate.’

‘Since 1998, [RBFF] has helped build what has become a $230.5 billion industry that supports 1.1 million American jobs, generates $263 million in tax revenue, and contributes $2 billion annually to fisheries and conservation efforts in all 50 states,’ RBFF’s statement continued.

‘Alarmingly, in just the past two months since RBFF’s funding has been paused, fishing license sales are down 8.6% across 16 states, representing the loss of over $590 million in angler spending and 5,600 jobs.’

Several other groups came to RBFF’s defense.

Matt Gruhn, president of the Marine Retailers Association of the Americas, told Fox News Digital he was disappointed in Interior’s decision to terminate the grant.

‘[RBFF’s] work was pivotal to enhancing the recreational boating and fishing industry’s recruitment, retention and reactivation efforts. Their training and resources vastly improved state agency processes and marketing and has made boating and fishing licensing and registration far easier for Americans,’ Gruhn said.

‘RBFF has been a responsible steward of these taxpayer dollars from the very beginning, with oversight from the very stakeholders that paid into the fund that RBFF’s grant originates from, as well as passing every audit with flying colors.’

Additionally, the head of the American Sportfishing Association warned of the ‘severe impact’ the loss of grant money will have on the outdoors industry.

CEO Glenn Hughes said his organization’s members agreed in 1950 to self-impose a tax on fishing rods to reinvest back into the industry and bolster license sales, habitat conservation and more.

The RBFF’s ‘Take Me Fishing’ campaign began in 1998 with congressional funding from the tackle tax. Hughes claimed the effort has generated a total of $230.5 billion in economic impact since.

‘Without consultation and coordination with the recreational fishing industry, the Department of the Interior decided to withhold critical funding from RBFF, ultimately ending a 27-year history of increasing fishing participation and efforts to bolster the economic impact of the fishing industry.’

This post appeared first on FOX NEWS