After years of advertising campaigns targeting ‘woke’ hospitals for putting politics before patients, a prominent nonprofit consumer advocacy group has compiled a comprehensive report on what it says are the worst offenders and urges President Donald Trump and lawmakers nationwide to take action.

The new report, titled ‘Woke hospitals: Embracing Political Priorities Ahead of Patient Care,’ was released by Consumers’ Research on Tuesday and took aim at five hospital systems across the country: Cleveland Clinic, Vanderbilt University Medical, Henry Ford Health, Memorial Hermann and Johns Hopkins All Children’s Hospital.

‘U.S. consumers should be aware that many nonprofit hospital systems have leveraged taxpayer dollars and federal funding to advance controversial political and social causes,’ the report states.

‘Instead of lowering costs and passing savings onto patients, hospitals have spent considerable money, time, and manpower pursuing a partisan agenda pertaining to Diversity, Equity, and Inclusion (DEI), radical gender ideology, and climate activism. This report examines five of these ‘woke’ hospital systems and the specific ways in which they have opted to engage in various forms of political activism unrelated to – and in some cases at odds with – their core missions as healthcare providers,’ the report continues. ‘Each of them is a tax-exempt beneficiary receiving numerous funding streams and benefits from the federal government.’

The report’s accusations against Cleveland Clinic, which Fox News Digital previously reported on, highlight a comment from CEO Tom Mihaljevic when he stated that ‘healthcare is only part of our mission.’

That mission, according to Consumers’ Research, includes promoting diversity, equity, and inclusion (DEI) which the hospital’s chief of diversity of inclusion said in 2023, ‘has to be embedded in everything we do.’

In addition to several examples of the hospital system pushing DEI, the report outlines ways that Cleveland Clinic has engaged in ‘climate activism’ while pouring millions into ‘green initiatives’ as well as administering transgender care to children.

Vanderbilt University Medical, a hospital system that Fox News Digital previously reported was found to be deleting some of its references to DEI commitments and resources while also keeping some and hiding them from public view, is said in the report to have received $468 million in NIH grants for medical research.

While receiving substantial funding from the federal government, the hospital system is also pushing a ‘woke’ agenda, according to the report.

‘VUMC’s Emergency Medicine Department featured a Diversity, Inclusion & Wellness Office co-led by two directors of ‘Inclusion, Diversity, Equity, and Anti-Racism,’’ the report states. ‘In January 2025, VUMC’s Psychiatry Department hosted a webinar addressing ‘The War on DEI,’ identifying racism, sexism, caste systems, and nationalism as significant barriers to DEI objectives.’

The report also outlines what it says are examples of VUMC promoting climate activism and providing ‘gender-affirming care’ to minors.

‘According to the nonprofit organization Do No Harm, VUMC has provided sex-change treatments to 33 minors since 2019, with 22 patients receiving irreversible body-altering surgery,’ the report states.

‘VUMC even awarded grants to a reproductive clinic in Memphis that assists LGBTQ+ youth in acquiring gender-change hormone therapy. Following the implementation of Tennessee’s new law, the clinic announced on its website that it now refers minors seeking such services to its affiliated clinic in Carbondale, IL, pending parental consent,’ the report continued.

Henry Ford Health has also been a previous target of Consumers’ Research, Fox News Digital reported in April, and is mentioned in the report as a place where the ‘racist DEI agenda is so egregious that America First Legal, a pro-Trump legal nonprofit, filed an official complaint with the Department of Health and Human Services (HHS) calling for an investigation.’

The report outlines several examples of the hospital allegedly pushing ‘gender ideology’ and cites Do No Harm’s database, which found that Henry Ford Health ‘treated at least 63 sex-change patients who were minors, including eight patients who underwent surgery.’

Memorial Hermann Health System in Texas was also highlighted by the report as an organization rife with examples of DEI, which critics for years have argued puts politics before patients.

‘Memorial Hermann maintains that ‘health equity’ is paramount,’ the report states. ‘The system has stated its intention of embedding EDI practices at the core of its mission and vision and believes overcoming ‘historical and contemporary injustices’ is critical.’

The report adds that ‘Memorial Hermann publicly claims not to offer gender-transition services to individuals under 18’ but, according to Do No Harm, ‘has reportedly performed 15 sex-change surgeries on minors and prescribed puberty blockers or hormone therapy to three children.’

The fifth hospital in the report, Johns Hopkins All Children’s Hospital, has said that it considers DEI to be part of its founding values and declared racism to be a ‘public health issue’ after the death of George Floyd.

The report states that the hospital ‘was the first hospital in the U.S. to offer transgender surgeries, doing so as early as 1966’ and pointed to a 2022 statement from a spokesperson that stated children should have access to transgender care to ‘improve their mental health.’

‘The Johns Hopkins All Children’s website formerly included a page about children’s gender and sexual development,’ the report says. ‘ It referred to the ‘emotional and physical foundation for sexuality’’ among ‘infants, toddlers, preschoolers, and young school-aged kids.’’

Fox News Digital reached out to all five hospitals in the report for comment.

‘Henry Ford Health respects and fully complies with all state and federal anti-discrimination laws,’ a Henry Ford Health spokesperson told Fox News Digital in a statement. ‘For more than a century, Henry Ford Health has been fully committed to serving Michigan’s richly diverse communities, providing health care services and employment opportunities to everyone. Our commitment to non-discrimination remains steadfast.’

In a statement to Fox News Digital, a Cleveland Clinic spokesperson said, ‘For more than a century, Cleveland Clinic’s mission has been to care for life, research for health, and educate those who serve. Cleveland Clinic is a nonpartisan organization and we neither have nor promote any political agenda. We are in full compliance with all state and federal laws and strongly refute the false and misleading assertions made in this report. The report intentionally shares information that is outdated.’

A VUMC spokesperson told Fox News Digital, ‘Vanderbilt University Medical Center fully complies with the current federal and state mandates and directives, and any accusations otherwise are simply false.’

A spokesperson for Memorial Hermann told Fox News Digital the report ‘reflects information that is outdated, factually inaccurate and intentionally misleading.’

‘As one example of factually inaccurate information, Memorial Hermann does not provide and has never provided any form of pediatric gender transitioning treatment to patients younger than 18 years of age at any of our facilities. Secondly, we are compliant with all state and federal price transparency regulations. As the largest nonprofit health system in Southeast Texas, we are committed to delivering compassionate, patient-centered care that provides high-quality outcomes to all we serve. We do not discriminate based on race, gender or any other characteristics, and we abide by ethical and legal standards of care. We are equally committed to ensuring our policies comply with all applicable federal, state, and local laws and regulations.’

One of the top concerns outlined in the report is what Consumers’ Research describes as ‘insult to injury’ when it comes to federal tax dollars propping up these hospitals that are pushing ‘woke’ ideologies and shelling out millions in salaries for top leadership.

‘Nonprofit hospitals highlighted in this report and across the U.S. receive millions of dollars in federal funding, government-mandated savings programs, and tax exemptions,’ the report states.

‘This means taxpayers are often left footing the bill for hospitals’ political activism. Hospitals receive nonprofit, tax-exempt status on the basis that they provide a broader benefit to the community. These health systems are able to couple their billions of dollars in tax savings with significant federal funding sources and government-mandated savings programs. These avenues for federal funding include Medicare payments, Medicaid payments, and federal grant funding.’

The report alleges that these hospitals often ‘leverage their position’ to receive ‘multiple special designations through Medicare and Medicaid that allow them access to more taxpayer dollars while arguing against federal cuts to current revenue streams.’

‘As outlined in this report, hospitals are taking advantage of their billions of dollars in tax breaks, federal funding, and mandated discount programs to fund frivolous projects outside the scope of patient care,’ the report alleges. ‘Instead of passing benefits along to patients and lowering costs – as these programs intended – hospitals use these programs to fund political priorities outside of their core mission of providing high-quality care and benefiting their communities.’

In addition to the report, Consumers’ Research has sent letters to President Trump, Senate and House leadership, and governors of the states where the hospitals are located calling for an investigation into the federal dollar funding streams to the organizations that could be violating anti-DEI rules and running counter to state values.

‘The content of this Consumer Warning should provide your administration with more than enough justification for initiating a formal investigation into these federally supported hospitals’ internal activities and a subsequent review of their tax-exempt privileges and the specific government funding streams which support them,’ the letter to Trump and officials in his administration states.

Additionally, Consumers’ Research is running a mobile billboard in Washington, D.C., and launching the website BadMedicine.Org to highlight their warning to consumers.

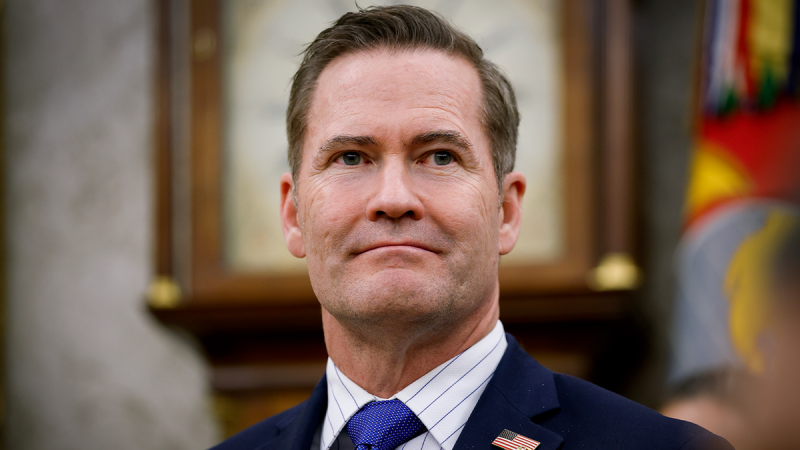

‘Consumers need to be aware that hospitals in their own backyards have found ways to use taxpayer dollars to advance a woke agenda, which takes away vital resources that should be going to patient care,’ Consumers’ Research Executive Director Will Hild said in a statement to Fox News Digital.

‘Our Consumer Warning spotlights five nonprofit hospitals that are prioritizing radical causes like DEI, child sex-change procedures, and climate activism, all while receiving millions in taxpayer dollars. Every hospital CEO should read this Consumer Warning and promptly end woke policies in their organizations and refocus on their core mission, which is providing the best quality patient care at affordable prices. Until every hospital in America stops pushing discriminatory DEI policies, mutilating kids’ bodies, and promoting climate politics, their federal funding streams and other government benefits like tax-exemptions should be investigated to ensure taxpayers are not supporting any hospital’s reckless ideological activism. It is time to stop funding woke hospitals.’

This post appeared first on FOX NEWS